Most finance books (especially those that do not focus on options) are written in a sloppy, approximate, non-rigorous way, sometimes going as far as assuming that the reader has no idea what a matrix is and is unable to ever understand that notion, which is not only rude but also leads to needlessly horrible formulas that you have to translate into matrices when you want to implement the ideas on your computer.

To that regard, Meucci's book is refreshing: while very easy to understand (should you want it, you can even skip all the formulas, if you do not want the details and do not want to implement the procedures described), it remains rigorous, gives all the details you need to be convinced of the correctness of its assertions and highlights all the traps people tend to fall into.

Among many, many other topics, the book explains that elliptic distributions (Gaussian, Student T and beyond) are amenable to computations and explains how to use the characteristic function of a probability distribution (or the fast Fourier transform (FFT)) to project a distribution estimated on a short horizon (say, one week) to a longer horizon (say, one year).

The coverage of copulas is remarquably clear but insufficient if you have other uses for them than checking which risk measures are fooled by options and which are option-proof.

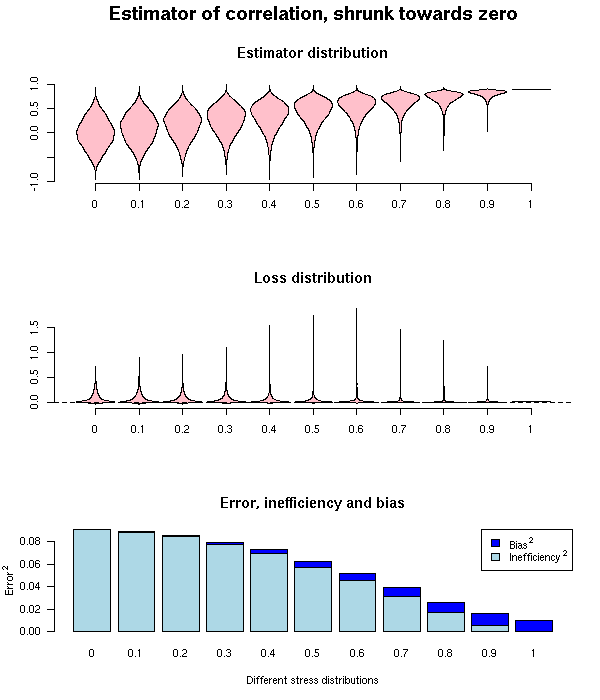

When building an estimator, for instance when trying to find the center of a cloud of points, people tend to prefer unbiased estimators. If you have very little data, this might not be a very good idea: unbiased estimators can have a very high variability and some biased estimators, while being centered on the wrong value, can end up with a lower average error. This is the case for shrinkage estimators: simply take a weighted mean of the sample mean and some prior guess -- this prior guess does not even have to be informative.

When building estimators, one should check their robustness: how do they behave if the distributional assumptions you made are not satisfied? The book suggests to stress-test them on a family of distributions that contain (or not) yours.

In spite of all its qualities, the book is not exhaustive. For instance, it is limited to a 1-period world: multi-period allocation and multi-period (path-dependant) risk measures, such as the drawdown, are absent. The handling of missing values, while correct (in many books or articles, the EM algorithm is incorrect), is insufficient for real data, with a lot of missing values (sometimes more than 50%) that are not even missing at random.

Here is a more comprehensive summary of this (excellent) book:

2007-06-17_Risk_and_asset_allocation.pdf

posted at: 19:17 | path: /Finance | permanent link to this entry